Introduction:

In today’s complex business landscape, corporate holding companies are emerging as sophisticated and strategic corporate structures, capable of offering unique solutions to a variety of organizational challenges and objectives. From tax optimization to the efficient management of business groups, holding companies have proven to be indispensable tools for entrepreneurs and corporations seeking to consolidate and expand their businesses effectively.

The adoption of holding structures varies significantly between different countries and regions, reflecting the particularities of each market, legal system and business environment. Let’s take a comparative look at the situation in different regions:

United States

In the US, the prevalence of holding structures is significant, although the exact percentage may vary depending on the sector and the index analyzed. It is estimated that around 80% of the companies listed on the S&P 500 use some form of holding company structure in their operations. This figure is particularly high in sectors such as finance, where bank holding companies are common, and in diversified conglomerates.

The popularity of holding companies in the US is driven by factors such as:

- Flexibility in managing multiple business lines

- Tax advantages, especially for companies with international operations

- Ease of separating risks between different business units

Europe

In Europe, the situation is more diverse due to the different legislation and business practices between countries. In markets such as Germany, France and the UK, it is estimated that between 60% and 70% of large listed companies use holding structures.

Factors influencing the adoption of holding companies in Europe include:

- Complexity of cross-border operations within the European Union

- Tradition of family conglomerates in countries such as Germany and Italy

- Specific regulations in sectors such as banking and insurance

Mexico

In Mexico, the adoption of holding structures has grown in recent years, although it is not as prevalent as in Brazil. Approximately 50% to 60% of the companies listed on the main index of the Mexican Stock Exchange (IPC) use holding structures.

Relevant aspects in the Mexican context:

- Influence of large family groups in the economy

- Growing internationalization of Mexican companies

- Search for tax efficiency and asset protection

South Korea

South Korea presents a unique scenario with its family conglomerates known as chaebols. It is estimated that more than 90% of the main companies listed on the Korean Stock Exchange (KOSPI) are part of complex holding structures.

Characteristics of the South Korean market:

- Dominance of large family-owned conglomerates

- Cross and circular ownership structures

- Recent reforms aimed at greater transparency and corporate governance

India

In India, the use of holding structures is common, especially among large conglomerates. Approximately 70% to 75% of the companies listed on the SENSEX index use some form of holding company structure.

Relevant factors in the Indian context:

- Significant presence of family business groups

- Complex regulatory and tax environment

- Need for efficient structures for operations in multiple states

Brazil

Recent data shows that more than 70% of Brazilian companies listed on the Bovespa Index use holding structures in their operations. This significant number underscores the relevance and widespread adoption of holding companies as corporate structuring and strategic planning tools in the Brazilian business scenario.

Relevant factors in the Brazilian context:

- Tax complexity

- Succession planning

- Asset protection

- Developing capital markets

- International Expansion

- Conglomerate Business Culture

- Economic Volatility

This guide has been meticulously designed to demystify the concept of the corporate holding company and explore its many facets, transforming complex corporate concepts into practical and applicable knowledge. Whether you’re a visionary entrepreneur looking to optimize your corporate structure, a lawyer specializing in corporate law, or a financial advisor serving a diverse business clientele, our goal is to provide a comprehensive and actionable understanding of corporate holding companies and their applications.

Part 1: Ready to Roll 🚀 – Basic Strategies and Practical Actions

Part 1, “Ready to Roll”, offers practical actions and immediate advice for entrepreneurs who need quick and effective guidance.

1. What is a Business Holding Company: Basic Concepts

A corporate holding company, also known as a holding company or parent company, is a corporate entity whose main activity is to hold equity stakes in other companies. Its primary purpose is to control and manage these subsidiary companies, often without directly producing goods or services.

Fundamental elements of a corporate holding company:

- Shareholding Control: The holding company holds a majority or significant stake in other companies, allowing it to control their operations.

- Centralized Management: Provides a structure for centralized management of multiple companies or business units.

- Asset Separation: The assets of the holding company are legally separated from the assets of the operating companies.

- Financial Flexibility: Allows for the efficient allocation of resources between group companies.

- Strategic Planning: Facilitates the implementation of long-term strategies for the entire business group.

Important characteristics:

- Pyramid Structure: Many holding companies are organized in a pyramid structure, with the holding company at the top controlling several subsidiaries.

- Diversification: Allows diversification of investments and risks across multiple companies and sectors.

- Tax efficiency: Offers opportunities for tax optimization within legal limits.

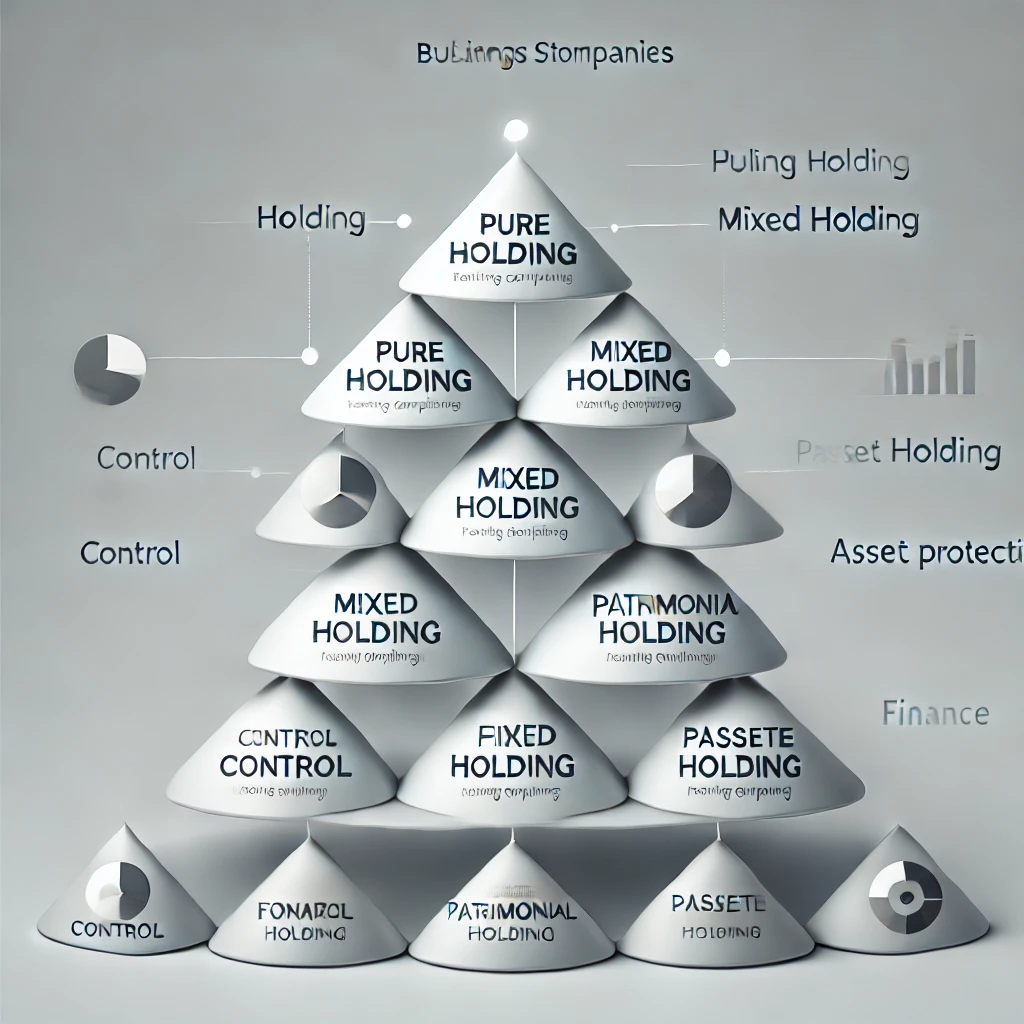

2. Types of Business Holdings

There are several types of corporate holding companies, each with specific characteristics and objectives:

- Pure Holding:

- Dedicated exclusively to holding stakes in other companies.

- It does not carry out its own operational activities.

- Focuses on stake management and corporate strategy.

- Mixed Holding:

- In addition to participating in other companies, it also carries out its own operational activities.

- Combines characteristics of a holding company with direct operations.

- Offers greater flexibility, but can complicate the tax and operational structure.

- Asset holding company:

- Focused on the management and protection of assets, such as real estate and investments.

- Generally used for succession planning and asset protection.

- Holding company:

- Its main objective is to maintain shareholder control of other companies.

- Generally holds more than 50% of the voting shares of subsidiaries.

- Administrative holding company:

- Centralizes the management of a group of companies.

- Focuses on standardizing processes and optimizing administrative resources.

- Financial holding company:

- Acts as the financial center of the corporate group.

- It manages loans, financing and investments for the subsidiaries.

3. Advantages and Challenges of Corporate Holdings

Advantages:

- Tax optimization:

- Possibility of reducing the tax burden through efficient tax planning.

- Taking advantage of specific tax benefits for holding companies.

- Asset protection:

- Segregation of risks between different businesses and assets.

- Protection of assets against possible problems in operating companies.

- Centralized management:

- Facilitates the implementation of uniform corporate strategies.

- Improves operational efficiency and control over subsidiaries.

- Succession planning:

- Simplifies the transfer of control and ownership between generations.

- Facilitates the professionalization of management in family businesses.

- Access to capital:

- Can improve access to sources of finance and investment.

- Enables financial consolidation, potentially improving financial indicators.

Challenges:

- Administrative complexity:

- Requires more sophisticated governance structures.

- May increase bureaucracy and administrative costs.

- Regulation:

- Subject to specific regulations, especially in sectors such as finance.

- Requires strict compliance with corporate and tax laws.

- Potential Conflicts of Interest:

- Can generate conflicts between the interests of the holding company and subsidiaries.

- Need clear policies for dealing with transactions between related parties.

- Market perception:

- Complex structures can be viewed with skepticism by investors and regulators.

- Requires transparency and effective communication with stakeholders.

- Implementation costs:

- Establishing a holding structure can involve significant initial costs.

- It requires ongoing investment in management and control systems.

Part 2: Deep Dive 🤿 – Technical Delving into Advanced Strategies

Part 2, “Deep Dive”, provides in-depth analysis for those wishing to delve into the technical and complex aspects of international finance.

4. Legal and Regulatory Aspects: A Global Perspective

The creation and operation of corporate holding companies involves significant legal and regulatory considerations, which vary considerably between different jurisdictions. We will look at the main features in the USA, Europe, Mexico, South Korea, India and Brazil.

Legal constitution

USA

- Corporate Type: Commonly incorporated as Corporations (C-Corps or S-Corps) or Limited Liability Companies (LLCs).

- Registration: State registration, usually in states such as Delaware, Nevada or Wyoming, known for their favorable corporate laws.

- Corporate Purpose: Broad flexibility in defining corporate purpose.

Europe

- Corporate type: Varies by country. In Germany, AG (Aktiengesellschaft) or GmbH; in France, SA or SARL; in the UK, Ltd or PLC.

- Registration: Registration processes vary by country, usually involving national or regional commercial registration.

- Corporate purpose: Specific requirements vary, being more detailed in civil law countries.

Mexico

- Company Type: Usually S.A. de C.V. (Sociedad Anónima de Capital Variable) or S. de R.L. de C.V. (Sociedad de Responsabilidad Limitada de Capital Variable).

- Registration: Register with the Public Trade Registry and obtain an RFC (Registro Federal de Contribuyentes).

- Corporate Purpose: Must be specific and detailed in the memorandum of association.

South Korea

- Corporate Type: Predominantly Jusik Hoesa (similar to Corporations) for large holding companies.

- Registration: Register with the Supreme Court Registry Office and obtain a Business Registration Certificate.

- Corporate Purpose: Must be clearly defined, with restrictions in certain sectors for holding companies.

India

- Type of Company: Mainly Private Limited Companies or Public Limited Companies.

- Registration: Registration with the Ministry of Corporate Affairs and obtaining a CIN (Corporate Identity Number).

- Corporate Purpose: Must be specific and in line with the activities permitted for holding companies.

Brazil

- Type of Company: Generally S.A. (Sociedade Anônima) or Ltda. (Sociedade Limitada).

- Registration: Register with the Board of Trade and obtain a CNPJ.

- Corporate Purpose: Must be carefully defined in the articles of association.

Sector regulations

- USA: Strict regulation for financial holding companies (Bank Holding Company Act) and sectors such as energy and telecommunications (FCC, FERC).

- Europe: Harmonized regulation at EU level for sectors such as banking (ECB) and energy (ACER), with national variations.

- Mexico: Specific regulation for financial holding companies (CNBV) and strategic sectors such as energy (CRE, CNH).

- South Korea: Strict regulation for chaebols, with a focus on transparency and limiting cross-ownership.

- India: Sectoral regulation by agencies such as RBI (banking) and SEBI (capital markets).

- Brazil: Specific regulation by the Central Bank and CVM for financial holding companies, and sectoral regulatory agencies (e.g. ANEEL, ANATEL).

Corporate governance

- USA: Focus on transparency (Sarbanes-Oxley Act) and protection of minority shareholders.

- Europe: Country-specific corporate governance codes, with EU guidelines.

- Mexico: Growing emphasis on governance practices, influenced by international standards.

- South Korea: Recent reforms aimed at improving transparency and reducing excessive family control.

- India: SEBI regulations for corporate governance, with a focus on transparency and investor protection.

- Brazil: Corporate Law (6.404/76) for S.A.s, with increasing importance of shareholder agreements and compliance programs.

Tax aspects

- USA: Tax consolidation regime for corporate groups; strict CFC (Controlled Foreign Corporation) rules.

- Europe: Significant variation between countries; participation regimes for dividend exemption in many countries.

- Mexico: Tax integration system for groups; transfer pricing rules in line with OECD guidelines.

- South Korea: Limited fiscal consolidation regime; increasing focus on international fiscal transparency.

- India: No fiscal consolidation; complex rules for taxing dividends and international transactions.

- Brazil: Careful analysis of dividend taxation regime; own transfer pricing rules, different from OECD guidelines.

In all jurisdictions, tax planning within legal limits is a crucial consideration when structuring holding companies, requiring careful analysis of local legislation and applicable international treaties.

5. Financial and accounting structuring

Proper financial and accounting structuring is fundamental to the success of a holding company:

Consolidated Accounting:

- ConsolidatedFinancial Statements: Preparation of consolidated balance sheets and income statements.

- Accounting Standards: Adherence to USGAAP (United States Generally Accepted Accounting Principles), IFRS (International Financial Reporting Standards).

- Auditing: Implementation of internal and external auditing processes.

Financial Management:

- Centralized Treasury: Centralization of the group’s cash and investment management.

- Dividend Policy: Establishment of clear dividend distribution policies.

- Debt Management: Strategies to optimize the group’s capital structure.

Cost Control:

- Shared Services Center: Implementation of structures for sharing administrative services.

- Performance Analysis: Development of metrics and KPIs to evaluate the performance of subsidiaries.

Tax Planning:

- Tax structuring: Design of structures to optimize the group’s tax burden.

- Utilization of Tax Losses: Strategies for the efficient use of accumulated tax losses.

- Transfer Pricing: Implementation of transfer pricing policies in compliance with legislation.

6. Strategy and Portfolio Management

Strategic portfolio management is a critical function of corporate holding companies:

Portfolio Analysis:

- BCG Matrix: Use of tools such as the BCG Matrix for business portfolio analysis.

- Synergy assessment: Identification and exploitation of synergies between group companies.

- Divestments: Strategies for divesting non-core or underperforming businesses.

Expansion and Acquisitions:

- M&A: Strategies for mergers and acquisitions for group growth.

- Due Diligence: Robust due diligence processes for evaluating potential acquisitions.

- Post-Acquisition Integration: Detailed plans for integrating acquired companies.

Innovation and Development:

- Innovation Centers: Establishment of shared R&D centers.

- Corporate Venture Capital: Investments in startups and new technologies.

- Digital Transformation: Strategies for digitizing and modernizing the group’s companies.

Risk Management:

- Risk Map: Development of comprehensive risk maps for the group.

- Hedge Policies: Implementation of hedge strategies for financial risks.

- Contingency Plans: Drawing up plans for crisis scenarios and market disruption.

7. Corporate Governance in Business Holdings

A robust governance structure is essential for the success and longevity of a corporate holding company:

Governance Structures:

- Board of Directors: Establishment of a board with independent members.

- Specialized Committees: Creation of audit, risk, strategy, etc. committees.

- Executive Board: Clear definition of the board’s roles and responsibilities.

Policies and Procedures:

- Code of Ethics: Implementation of a comprehensive code of ethics for the entire group.

- Related Party Transactions Policy: Establishment of clear rules for intra-group transactions.

- Information Disclosure Policy: Guidelines for transparent communication with stakeholders.

Internal Controls:

- Internal Audit: Establishment of a robust internal audit function.

- Risk Management: Implementation of a corporate risk management framework.

- Compliance: Development of a comprehensive compliance program.

Stakeholder Relations:

- Dividend Policy: Establishment of a clear and consistent dividend policy.

- Investor Relations: Creation of an effective investor relations structure.

- Corporate Social Responsibility: Development of CSR programs in line with the group’s strategy.

8. Challenges and Future Trends

Corporate holding companies face significant challenges and must be aware of emerging trends:

Current Challenges:

- Regulatory Complexity: Increasing regulation in various sectors.

- Pressure for Transparency: Growing demand for greater corporate transparency.

- Technological Disruption: The need to adapt quickly to technological changes.

- Globalization: Managing operations in multiple jurisdictions.

- Sustainability: Integration of ESG (Environmental, Social, and Governance) practices into corporate strategy.

Future trends:

- Digitalization: Growing adoption of technologies such as AI, blockchain and analytics in corporate management.

- Flexible Business Models: Evolution towards more agile and adaptable structures.

- Focus on Purpose: Alignment of corporate strategies with broader social purposes.

- Talent Management: New approaches to attracting and retaining talent in complex structures.

- Intersectoral Collaboration: Increasing partnerships and business ecosystems.

Some considerations:

Business holding companies represent a sophisticated evolution in corporate structuring, offering significant benefits in terms of operational efficiency, tax optimization and strategic management. However, their implementation and effective management require careful planning, multidisciplinary expertise and a robust governance approach.

When considering the creation or restructuring of a corporate holding company, it is crucial:

- Have clear objectives aligned with the group’s long-term strategy.

- Seek expert advice in areas such as corporate law, taxation and corporate governance.

- Carry out a detailed analysis of the financial, operational and strategic impacts of the holding company structure.

- Implement a robust and transparent corporate governance system.

- Keep up to date with regulatory changes and market trends that may affect the holding company structure.

Adopting a corporate holding structure can be a powerful catalyst for organizational growth and efficiency, but it requires an ongoing commitment to management excellence and adaptability to changes in the business environment.

For those considering implementing or optimizing a corporate holding structure, I invite you to join our next exclusive webinar: “Masterclass in Corporate Holdings: Advanced Strategies for Corporate Efficiency and Sustainable Growth”. In this event, we will discuss detailed case studies and offer practical insights from industry experts.

Conclusion

Corporate holding companies represent a sophisticated evolution in corporate structuring, offering a powerful vehicle for strategic management, operational and financial optimization, and sustainable growth. Their relevance in the modern business landscape is undeniable, providing organizations with the flexibility and robustness needed to navigate an increasingly complex and dynamic business environment.

However, the success of a holding structure is not guaranteed by its implementation alone. It requires a clear strategic vision, meticulous execution and continuous, adaptive management. The challenges are significant – from administrative complexity to regulatory and market risks – but the potential benefits in terms of efficiency, synergy and added value can be transformative for a business group.

When considering implementing or optimizing a holding company structure, it is crucial to:

- Align the structure with the group’s long-term strategic objectives.

- Invest in robust corporate governance and risk management systems.

- Remain agile and adaptable to changes in the business environment.

- Foster a culture of innovation and continuous learning throughout the group.

- Integrate sustainability and social impact considerations into corporate strategy.

Remember, a well-structured and managed holding company can be much more than a legal entity – it can be the catalyst for sustainable value creation, the platform for innovation and growth, and the vehicle for realizing an ambitious, long-term corporate vision.

As we move into an increasingly complex and interconnected future, corporate holding companies will continue to evolve, adapting to the new realities of the global marketplace, the changing expectations of stakeholders and the emerging challenges of the business world. Those who can successfully navigate this landscape, taking advantage of the unique benefits offered by holding structures, will be well placed to lead and thrive in the 21st century business landscape.

FAQs

- Q: What is the main difference between a pure holding company and a mixed holding company? A: A pure holding company is dedicated exclusively to holding stakes in other companies, without carrying out any operational activities of its own. A mixed holding company, on the other hand, not only holds shares, but also carries out direct operational activities.

- Q: Can a holding company be set up as a small business? A: Yes, it is possible to set up a holding company as a small business, depending on the turnover and the planned structure. However, it is important to consider that, as the holding company grows and becomes more complex, it may be necessary to migrate to more robust structures.

- Q: What are the main tax benefits of a holding company? A: The tax benefits can include the possibility of a reduction in the taxation of dividends, optimization of the tax burden in transactions involving the purchase and sale of shareholdings, and the potential for better use of tax losses. However, it is crucial to consult a tax specialist for a specific analysis of your situation.

- Q: How can a holding company facilitate the succession process in family businesses? A: A holding company can facilitate succession by centralizing control of operating companies, allowing for a smoother transition of shareholder control to new generations. In addition, it can establish governance structures that separate management from ownership, facilitating the professionalization of the company.

- Q: What are the risks of concentrating all the companies under a single holding company? A: The main risks include potential administrative complexity, the possibility of reputational contamination between group companies, and the risk that problems in one subsidiary will affect the entire group. It is important to implement robust governance and risk management structures to mitigate these risks.

- Q: How can a holding company help attract investment? A: A holding company can facilitate attracting investment by offering a consolidated view of the business group, potentially improving financial indicators and offering greater security to investors. It can also create more attractive structures for different types of investors, such as private equity or venture capital.

- Q: Is there a minimum number of companies required to justify the creation of a holding company? A: There is no legal minimum number, but generally the creation of a holding company is justified when there are at least two or more companies or significant assets to be managed. The decision should be based on a cost-benefit analysis and specific strategic objectives.

- Q: How does a holding company deal with companies in different sectors or countries? A: Holding companies can create sub-holdings specialized by sector or geographic region to better manage the specifics of each business. This allows for more focused management adapted to the particularities of each sector or country, while maintaining strategic coordination at the level of the main holding company.

- Q: What are the implications of having a listed holding company? A: A listed holding company is subject to stricter governance, transparency and disclosure requirements. This can bring benefits in terms of access to capital and credibility in the market, but it also implies additional compliance costs and pressure for short-term results.

- Q: How do you assess whether a holding company structure is the most appropriate for a business group? A: The suitability of a holding company structure should be assessed considering factors such as long-term strategic objectives, succession planning needs, tax efficiency, capital raising requirements, and the group’s operational complexity. It is advisable to carry out a detailed analysis with specialized consultants to determine the ideal structure.

Additional Considerations for Business Holdings

For a deeper understanding and effective application of corporate holding companies, it is important to consider some additional aspects:

1. Holdings and Corporate Innovation

Holding companies can play a crucial role in promoting innovation within business groups:

- Corporate Venture Capital: Establishing venture capital arms to invest in startups and new technologies.

- Internal Incubation: Creating protected environments for the development of new businesses and disruptive models.

- Innovation Partnerships: Facilitating collaborations between different business units and external partners to foster innovation.

2. Holdings in Internationalization Strategies

Holdings are often used in international expansion strategies:

- Intermediary Holdings: Use of holding companies in strategic jurisdictions to facilitate entry into new markets.

- International Tax Optimization: Structuring to take advantage of double taxation treaties and favorable tax regimes.

- Geopolitical Risk Management: Geographical diversification to mitigate country-specific political and economic risks.

3. Holdings and Digital Transformation

Digital transformation is significantly impacting the way holding companies operate:

- Data Centralization: Implementation of data lakes and advanced analytics to improve decision-making at the group level.

- Integrated Management Platforms: Adoption of ERP systems and business intelligence tools for a holistic view of the group.

- Cybersecurity: Development of robust cybersecurity strategies to protect the group’s critical assets and information.

4. Holdings in Restructuring and Turnaround Contexts

Holdings can be instrumental in corporate restructuring processes:

- Carve-outs: Facilitating spin-offs and divestitures of business units.

- Market consolidation: Structuring mergers and acquisitions to consolidate positions in fragmented markets.

- Business Turnaround: Use of the holding company structure to isolate and recover business units in difficulty.

5. Holdings and Corporate Sustainability

There is a growing emphasis on integrating sustainable practices into holding structures:

- Integrated ESG Policies: Development of Environmental, Social, and Governance (ESG) policies at group level.

- Impact Investing: Allocating capital to businesses and projects with a positive social and environmental impact.

- Integrated Reporting: Implementation of integrated reporting practices, combining financial and non-financial information.

The Future of Corporate Holdings

Looking to the future, we can anticipate several trends that will shape the landscape of corporate holding companies:

- Organizational agility: Evolution towards more flexible and adaptable structures, capable of responding quickly to market changes.

- Blockchain Technology: Potential use of blockchain to improve transparency and efficiency in intra-group transactions and corporate governance.

- Artificial Intelligence in Management: Greater adoption of AI and machine learning to optimize processes and make strategic decisions.

- Focus on Purpose: Increasing alignment of holding company strategies with broader social and environmental purposes.

- New Working Models: Adaptation to hybrid and remote working models, impacting management and corporate culture.

- Increased Regulation: Expectation of greater regulatory scrutiny, especially in areas such as fiscal transparency and antitrust practices.

- Ecosystem management: Evolution from holding companies to orchestrators of business ecosystems, integrating partners, suppliers and even competitors.

Member of the IMA (Institute of Management Accountants) – USA

Member of the AICPA (American Institute of CPAs) – USA

Member of AAII (American Association of Individual Investors) – USA

Member of AAA (American Accounting Association) – USA

Member of the FMA (Financial Management Association) – USA

These associations not only attest to Kleyton’s commitment to professional excellence, but also ensure that his knowledge is always at the forefront of international financial and accounting practices.

With a robust academic background, including a Bachelor’s degree in Accounting and MBAs in International Finance and Accounting, as well as in International Business, Kleyton offers a unique and comprehensive perspective on the global business landscape.

Through the Tartarotti Report, Kleyton invites visionary entrepreneurs and executives to connect, explore opportunities for collaboration and, together, successfully navigate the complex world of international corporate finance.