Introduction:

In the complex landscape of international estate and financial planning, trusts have emerged as powerful and versatile instruments, capable of offering unique solutions for a variety of objectives. From asset protection to sophisticated succession planning, trusts have proven to be indispensable tools for individuals and families looking to effectively manage and preserve their wealth.

Recent figures show that the global trust services market is expected to reach US$5.5 billion by 2025, with a compound annual growth rate of 4.9%. This significant growth underscores the growing relevance and adoption of trusts as financial and succession planning instruments on a global scale.

This guide has been meticulously designed to demystify the concept of trusts and explore their various types, transforming complex legal concepts into practical and applicable knowledge. Whether you are a visionary entrepreneur looking to protect your legacy, a lawyer specializing in international law, or a financial advisor serving a global clientele, our goal is to provide you with a comprehensive and actionable understanding of trusts and their applications.

Part 1: Ready to Roll 🚀 – Basic Strategies and Practical Actions

Part 1, “Ready to Roll”, offers practical actions and immediate advice for entrepreneurs who need quick and effective guidance.

1. What is a Trust: Basic Concepts

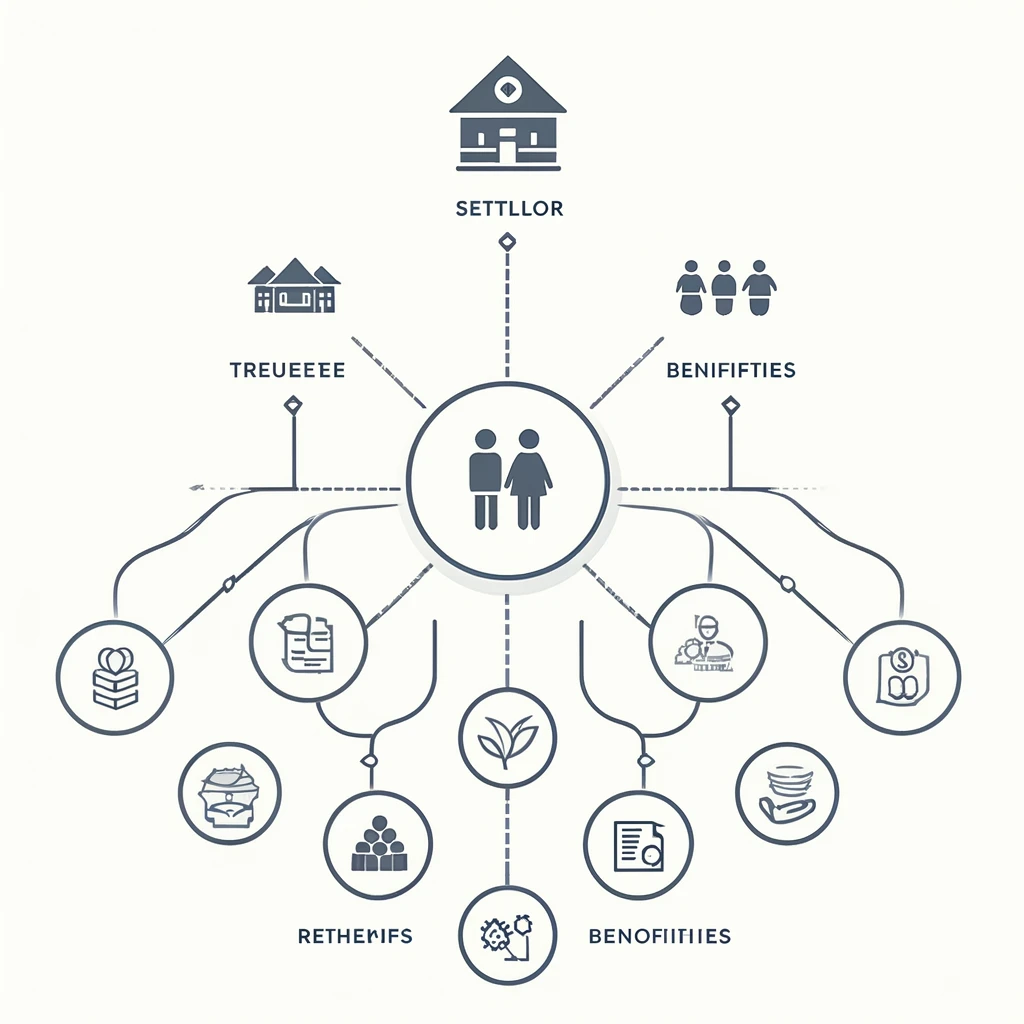

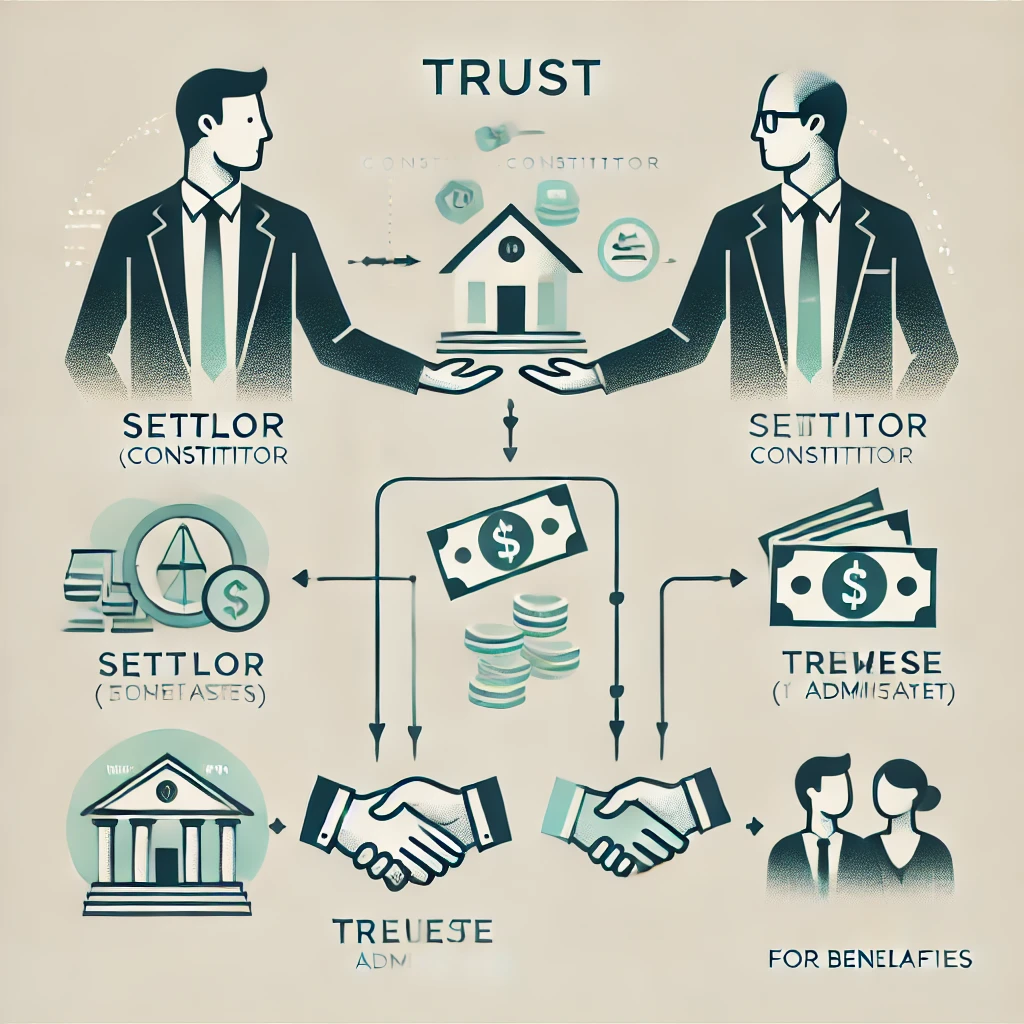

A trust is a legal relationship in which one person (the settlor or settlor) transfers ownership of assets or rights to another person (the trustee or trustee) so that the latter manages them for the benefit of a third party (the beneficiaries) or for a specific purpose.

Fundamental elements of a trust:

- Settlor: The person who creates the trust and transfers the assets to it.

- Trustee: The person or entity responsible for managing the trust assets in accordance with the established terms.

- Beneficiaries: The persons or entities that benefit from the trust assets.

- Trust Assets: The assets or rights transferred to the trust.

- Deed of Trust: The document that sets out the terms and conditions of the trust.

Important features:

- Separation of Property: The trust assets are legally separated from the personal property of the settlor, trustee and beneficiaries.

- Confidentiality: Trusts generally offer a high level of privacy.

- Flexibility: Trusts can be structured in different ways to meet specific objectives.

2. Developing Strategies with Trusts

When considering implementing a trust, it is crucial to develop a clear strategy:

- Define the Objectives:

- Asset protection

- Succession planning

- Tax optimization

- Philanthropy

- Investment management

- Choose the right type of trust:

- Revocable vs. Irrevocable

- Discretionary vs. Fixed

- Domestic vs. Offshore

- Select Jurisdiction:

- Consider factors such as political stability, legal system, tax regime and international recognition.

- Structure the Terms of the Trust:

- Define the powers of the trustee

- Establish the distribution rules for the beneficiaries

- Include protection and flexibility clauses

- Tax planning:

- Analyze the tax implications in the jurisdiction of the settlor, the trust and the beneficiaries

- Consider double taxation treaties and regulations such as CRS and FATCA

3. Creating and Maintaining an Effective Trust

To ensure the effectiveness and longevity of a trust:

- Choice of Trustee:

- Select a competent and reliable trustee

- Consider using professional or corporate trustees for complex trusts

- Proper documentation:

- Prepare a detailed and clear trust deed

- Keep complete records of all transactions and decisions

- Review and update regularly:

- Periodically review the terms of the trust to ensure that they remain aligned with the objectives

- Update the trust as necessary to adapt to changes in circumstances or legislation

- Communication with Beneficiaries:

- Establish a clear communication protocol with beneficiaries

- Educate beneficiaries about their rights and responsibilities

- Compliance and Governance:

- Implement robust compliance practices to ensure compliance with laws and regulations

- Establish a governance framework for complex family trusts

Part 2: Deep Dive 🤿 – Technical Deep Dive into Advanced Strategies

Part 2, “Deep Dive”, provides in-depth analysis for those who want to dive into the technical and complex aspects of international finance.

4. Detailed Analysis of Types of Trusts

In this section, we will explore the various types of trusts and their specific characteristics:

1. Revocable vs. Irrevocable Trusts

Revocable Trusts:

- The settlor retains control and can change or revoke the trust at any time

- Offer flexibility, but less asset protection and tax benefits

- Useful for life estate management and simple succession planning

Irrevocable trusts:

- Once established, they cannot be easily changed or revoked by the settlor

- Offer greater asset protection and potential tax benefits

- Suitable for advanced succession planning and asset protection

2. Discretionary vs. Fixed Trusts

Discretionary Trusts:

- The trustee has discretion over how and when to distribute assets to beneficiaries

- Offer greater flexibility and protection from beneficiaries’ creditors

- Ideal for long-term succession planning and families with variable needs

Fixed Trusts:

- Beneficiaries have fixed, predetermined rights over the trust assets

- Offer greater certainty for beneficiaries, but less flexibility

- Useful when you want to guarantee specific and regular distributions

3. Domestic vs. Offshore Trusts

Domestic trusts:

- Established in the settlor’s jurisdiction of residence

- Generally simpler to administer and understand

- Subject to local laws and regulations

Offshore Trusts:

- Established in foreign jurisdictions

- Can offer tax advantages and greater asset protection

- Require careful consideration of international regulations and compliance issues

4. Specialized types of trusts

a. Charitable Trusts:

- Created for charitable purposes

- Can offer significant tax advantages

- Examples include private foundations and public charitable trusts

b. Asset Protection Trusts:

- Designed specifically to protect assets against creditors

- Usually established in jurisdictions with favorable asset protection laws

- Require careful planning to avoid creditor fraud issues

c. Purpose Trusts:

- Created for a specific purpose, rather than identifiable beneficiaries

- Common in offshore jurisdictions

- Useful for holding assets such as shares in family businesses or valuables

d. Blind Trusts:

- The settlor and beneficiaries have no knowledge or control over the trust’s investments

- Used to avoid conflicts of interest, especially by public figures

e. Spendthrift Trusts:

- Designed to protect beneficiaries who may not be financially responsible

- Limit beneficiaries’ access to the trust’s principal

f. Generation-Skipping Trusts:

- Transfer assets to grandchildren or later generations, potentially reducing inheritance taxes

- Useful for families with significant assets who wish to preserve wealth for several generations

Case Study: Trust Structure for an International Business Family

Consider the Silveira family, owners of a technology company with operations in Brazil, the USA and Europe:

- Structure:

- Irrevocable Discretionary Trust established in the Cayman Islands

- Operating subsidiaries held in a holding company under the trust

- Strategy

- Asset protection against business risks and litigation

- Succession planning for multiple generations

- Tax optimization considering multinational operations

- Results:

- Effective separation of family ownership and business management

- Flexibility for distributions based on the changing needs of family members

- Mitigation of inheritance taxes in multiple jurisdictions

- Governance:

- Investment Committee to oversee the management of the trust’s assets

- Family Protocol established to guide decisions and resolve conflicts

5. Implementation and Management of Trusts

The effective implementation and management of trusts requires a sophisticated approach and the use of modern tools:

- Trust Management Software:

- Platforms such as TrustQuay or Viewpoint offer comprehensive solutions for trust administration

- Features include accounting, reporting and compliance management

- Risk analysis tools:

- Use financial modeling software to evaluate different scenarios and their impacts on the trust

- Consider platforms such as @Risk or Crystal Ball for sophisticated analysis

- Compliance systems:

- Implement robust solutions for KYC (Know Your Customer) and AML (Anti-Money Laundering)

- Tools such as ComplyAdvantage can help with continuous monitoring of regulatory risks

- Secure Communication Platforms:

- Use encrypted communication systems for interactions between trustees, beneficiaries and advisors

- Consider solutions such as Proton Mail or Signal for sensitive communications

- Document management:

- Implement a secure digital document management system

- Platforms like DocuSign can be useful for electronic signatures on trust documents

6. Risk Management and Mitigation in Trusts

Effective risk management is crucial to the long-term success of any trust structure:

- Regulatory Risk:

- Strategy: Keep up to date with changes in trust laws and global tax regulations

- Action: Carry out regular compliance audits and consider hiring consultants specializing in international regulations

- Litigation risk:

- Strategy: Structure the trust to maximize protection against creditors and potential litigation

- Action: Include flee clauses and consider using trusts in jurisdictions with strong litigation protection

- Investment risk:

- Strategy: Develop a robust and diversified investment policy

- Action: Implement an investment committee and consider hiring professional investment managers

- Succession Risk:

- Strategy: Carefully plan the succession of trustees and the transition of control to future generations

- Action: Develop a detailed succession plan and educate younger generations about the trust’s structure and purpose

- Reputational risk:

- Strategy: Maintain high ethical standards and transparency in the management of the trust

- Action: Implement robust governance policies and consider including independent members on the trust’s advisory committee

7. Avoid Common Mistakes in Structuring and Managing Trusts

Avoid these common mistakes to ensure the effectiveness and longevity of your trust:

- Lack of Clarity in Objectives:

- Mistake: Establishing a trust without clear and well-defined objectives

- Prevention: Carefully document the trust’s objectives and review them periodically

- Inadequate choice of trust type:

- Mistake: Selecting a trust type that does not align with the settlor’s objectives

- Prevention: Consult experts to assess which type of trust best suits your specific needs

- Negligence in Trustee Selection:

- Mistake: Choosing a trustee without the necessary experience or resources

- Prevention: Carefully consider the trustee’s qualifications and evaluate the option of professional or corporate trustees

- Lack of Flexibility:

- Mistake: Creating a very rigid trust structure that doesn’t adapt to circumstantial changes

- Prevention: Include flexibility mechanisms, such as amendment powers or decanting clauses

- Disregard Tax Implications:

- Mistake: Neglecting proper tax planning when establishing the trust

- Prevention: Conduct a comprehensive tax analysis considering all relevant jurisdictions

Conclusion

Some considerations:

Trusts are powerful and versatile tools in the arsenal of international wealth and financial planning. Their ability to offer asset protection, tax efficiency and flexibility in succession planning make them very important instruments for individuals and families with significant wealth and global interests.

However, the complexity and nuances of the different types of trusts require a careful and well-informed approach. Choosing the right type of trust, selecting the right jurisdiction, and

the implementation of robust management and governance practices are essential to the long-term success of any trust structure.

By implementing the strategies and best practices discussed in this guide, you will be well positioned to reap the benefits of trusts, protecting and perpetuating your assets across generations and borders. Remember, success in using trusts is not only measured by tax or legal efficiency, but by the ability to realize the settlor’s objectives in an ethical and sustainable manner.

To further deepen your knowledge in this crucial area, I invite you to take part in our next exclusive webinar: “Masterclass in Structuring Trusts: Advanced Strategies for the Global Scenario”. In this event, we will discuss detailed case studies and offer practical insights from industry experts. Register now and take the next step in optimizing your international estate planning!

FAQs

- Q: What are the main advantages of setting up a trust? A: The main advantages include asset protection, efficient succession planning, potential tax optimization, confidentiality and flexibility in wealth management. Trusts can offer a clear separation between legal ownership and economic benefit, which can be useful in various financial and family planning situations.

- Q: How do I choose between a revocable and irrevocable trust? A: The choice depends on your main objectives. Revocable trusts offer greater flexibility and control for the settlor and are useful for managing assets during life. Irrevocable trusts, on the other hand, offer greater asset protection and potential tax benefits, and are more suitable for long-term succession planning and protection against creditors.

- Q: What are the tax implications of setting up an offshore trust? A: The tax implications of an offshore trust can be complex and vary depending on the jurisdictions involved (of the settlor, the trust and the beneficiaries). In general, they can offer tax advantages, but it is crucial to consider regulations such as CRS, FATCA and CFC (Controlled Foreign Corporation) rules. It is essential to carry out a detailed tax analysis and remain compliant with all relevant reporting obligations.

- Q: How are trusts affected by forced heirship laws in civil law countries? A: Trusts can face challenges in jurisdictions with forced heirship laws (such as many countries in Latin America and Continental Europe). Strategies to deal with this can include the use of trusts in jurisdictions that do not recognize such laws, combined with choice-of-law clauses. However, it is crucial to carefully consider the legal and tax implications in all relevant jurisdictions.

- Q: What is the difference between an individual trustee and a corporate trustee? A: An individual trustee is a natural person who administers the trust, while a corporate trustee is a legal entity (usually a specialized company) that performs this function. Corporate trustees generally offer greater continuity, diversified expertise and broader resources, but can be more expensive. Individual trustees can offer a more personal touch, but may lack the expertise or resources for complex trusts.

- Q: How do you ensure that a trust is recognized internationally? A: To maximize international recognition, consider establishing the trust in a jurisdiction that is a signatory to the Hague Convention on the Law Applicable to Trusts and their Recognition. Also, structure the trust according to international best practices and maintain robust documentation. In some cases, it may be useful to obtain legal opinions from relevant jurisdictions on the recognition of the trust.

- Q: What are the risks of using a trust for asset protection? A: The main risks include the possibility of the trust being considered a fraud on creditors if established too close to a legal action, challenges to the validity of the trust in jurisdictions that do not fully recognize the concept, and potential conflicts with forced heirship laws. In addition, poorly structured or inadequately managed trusts may not offer the desired protection.

- Q: How can trusts be used in business succession planning? A: Trusts can be powerful tools in business succession planning. They can be used to hold shares in family businesses, ensuring continuity in management while providing economic benefits to family members. Trusts can also facilitate the gradual transition of control to younger generations and establish clear governance structures for family businesses.

- Q: What are the emerging trends in the use of trusts internationally? A: Current trends include the increased use of purpose trusts, especially in offshore jurisdictions, greater focus on compliance and transparency due to global regulations, integration of blockchain technologies to improve traceability and efficiency, and the growing use of trusts in sustainable investment planning and strategic philanthropy.

- Q: How do trusts compare to other estate planning structures, such as foundations? A: Trusts and foundations have different characteristics. Trusts are legal relationships, while foundations are separate legal entities. Foundations may be preferable in civil law jurisdictions that do not fully recognize trusts. Trusts generally offer greater flexibility, while foundations can provide greater control to the founder. The choice between them will depend on the specific objectives, jurisdictions involved and preferences of the client.

Additional Considerations for Trusts

For a deeper understanding and effective application of trusts, it is important to consider some additional aspects:

1. Trusts and International Tax Planning

Trusts play a significant role in international tax planning, but their use requires care and expertise:

- Tax Transparency: With the global implementation of the Common Reporting Standard (CRS) and FATCA, tax transparency has become crucial. Trusts must be structured in full compliance with these regulations.

- Substance Over Form: Tax authorities globally are increasingly focusing on the economic substance of trust structures. It is essential that the trust has genuine purpose and substance beyond mere tax savings.

- Tax Exit Planning: When setting up international trusts, carefully consider the tax implications of any change of residence of the settlor or beneficiaries.

2. Trusts in Investment Planning

Trusts can be powerful tools for sophisticated investment strategies:

- Investment Pooling: Trusts can be used to pool investments from multiple family members, allowing access to larger-scale investment opportunities.

- Alternative Investment Structures: Consider using trusts in conjunction with structures such as Limited Partnerships or Companies for private equity or venture capital investments.

- Sustainable Investments: Trusts are increasingly being used to align investment strategies with family values, particularly in areas such as ESG (Environmental, Social, and Governance) investments.

3. Trusts and Technology

Technological developments are significantly impacting the administration and structuring of trusts:

- Smart Contracts: Explore the potential of blockchain-based smart contracts to automate certain trust functions, such as conditional distributions.

- Digital Asset Management: Develop specific strategies for including and managing digital assets (such as cryptocurrencies) in trust structures.

- Digital Governance Platforms: Use digital platforms to improve communication and decision-making between trustees, protectors and beneficiaries.

4. Trusts in Complex Family Contexts

Trusts can be adapted to suit a variety of complex family situations:

- Recomposed Families: Use trusts to balance the needs of current spouses and children from previous relationships.

- Special Needs Beneficiaries: Structure specific trusts to provide long-term care for special needs beneficiaries, without compromising potential government benefits.

- Planning for Longevity: As life expectancy increases, consider trusts that can meet the needs of multiple generations simultaneously.

5. Trusts and Global Philanthropy

Trusts offer unique opportunities for strategic philanthropy and global impact:

- Donor-Advised Funds: Explore the use of trusts in conjunction with donor-advised funds for a flexible approach to philanthropy.

- Impact Trusts: Structure trusts focused on impact investments, aligning financial returns with social or environmental objectives.

- Philanthropic Legacy: Use trusts to establish a lasting philanthropic legacy, involving future generations in the management and direction of charitable activities.

The Future of Trusts on the Global Scene

As we look to the future, several emerging trends and challenges will shape the use and structuring of trusts:

- Increased Regulation: Continued increased regulation and scrutiny of offshore structures is expected, requiring greater transparency and economic substance.

- Digitization and Automation: Trust administration will become increasingly digitized, with the use of AI and data analytics to optimize asset management and compliance.

- Adaptation to New Asset Classes: Trusts will evolve to accommodate new forms of wealth, such as digital assets, rapidly evolving intellectual property and new types of alternative investments.

- Focus on Sustainability: There will be a growing demand for trusts that incorporate ESG principles and contribute to sustainable development objectives.

- Continued Globalization: With the continued global mobility of individuals and families, trusts will adapt to meet increasingly international and multicultural needs.

Final Conclusion

Trusts remain key instruments in international estate and financial planning, offering a unique combination of flexibility, protection and efficiency. However, their effectiveness depends critically on a thorough understanding of their various types and applications, as well as careful and ethical implementation.

As we navigate the complex global legal and tax landscape, the key to success in using trusts lies in adaptability, strict compliance and the constant search for up-to-date knowledge. Professionals working with trusts must be prepared to continually evolve their practices, embracing new technologies and responding proactively to regulatory and social changes.

Remember, the ultimate goal of a trust is not just the preservation and growth of assets, but the realization of the settlor’s broader objectives – be they family protection, business continuity, philanthropic impact or the perpetuation of a lasting legacy.

By implementing the strategies and considerations discussed in this guide, you will be well placed to harness the power of trusts effectively and responsibly, creating structures that not only meet immediate needs, but are also robust and adaptable enough to thrive in the ever-evolving global landscape.

Keep educating yourself, keep up to date with changes in the international landscape and don’t hesitate to seek expert advice when necessary. The world of trusts is rich in nuances and complexities, and the right expertise can make all the difference between a successful structure and one that presents unnecessary risks or fails to achieve its objectives.

Remember, effective estate planning through trusts is not just a matter of financial optimization, but an exercise in long-term vision, aligning family values and creating a lasting positive impact.

Member of the IMA (Institute of Management Accountants) – USA

Member of the AICPA (American Institute of CPAs) – USA

Member of AAII (American Association of Individual Investors) – USA

Member of AAA (American Accounting Association) – USA

Member of the FMA (Financial Management Association) – USA

These associations not only attest to Kleyton’s commitment to professional excellence, but also ensure that his knowledge is always at the forefront of international financial and accounting practices.

With a robust academic background, including a Bachelor’s degree in Accounting and MBAs in International Finance and Accounting, as well as in International Business, Kleyton offers a unique and comprehensive perspective on the global business landscape.

Through the Tartarotti Report, Kleyton invites visionary entrepreneurs and executives to connect, explore opportunities for collaboration and, together, successfully navigate the complex world of international corporate finance.