Kleyton Tartarotti

162: Offshore Trusts: Preserving Family Wealth and Building a Lasting Legacy

Introduction: In the global wealth management landscape, offshore trusts are emerging as sophisticated instruments for preserving and passing on family ...

161: Atlas of Offshore Jurisdictions in the Americas and Caribbean: A Comprehensive Comparative Guide

Introduction: The landscape of offshore jurisdictions in the Americas and the Caribbean is diverse and complex, offering a variety of ...

160: Offshore Holding Companies: A Complete Guide for Beginners

Introduction: In today’s globalized business landscape, the efficient structuring of international assets has become not only a competitive advantage, but ...

159: International Succession Planning Guide for Transnational Families

Introduction: In today’s global landscape, where borders become increasingly fluid and international opportunities abound, succession planning for transnational families emerges ...

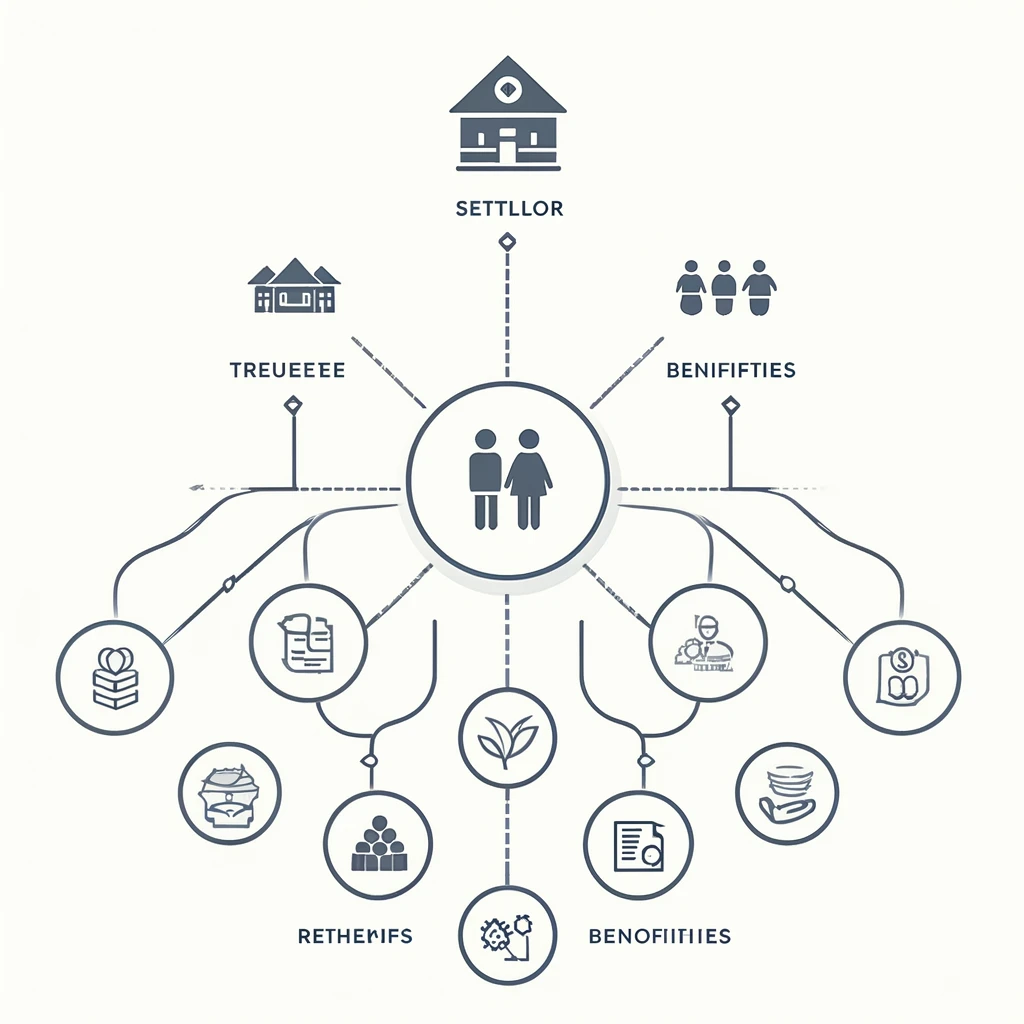

158: What is a Trust and its Types: A Complete Guide

Introduction: In the complex landscape of international estate and financial planning, trusts have emerged as powerful and versatile instruments, capable ...

157: Holding Companies: Um Guia Completo

Introdução: No dinâmico cenário empresarial global, as holding companies emergem como estruturas corporativas poderosas e versáteis, capazes de oferecer soluções ...

156: Who Can Open a Holding Company? A Complete Guide

Introduction: In today’s dynamic business and property landscape, holding companies have emerged as versatile and powerful structures, capable of meeting ...

155: How to Open a Family Holding: A Complete Guide

Introduction: In the modern business and wealth scenario, family holding companies have emerged as powerful and versatile structures, capable of ...

154: What is Corporate Holding: A Complete Guide

Introduction: In today’s complex business landscape, corporate holding companies are emerging as sophisticated and strategic corporate structures, capable of offering ...

140: Succession Planning in the Americas: Advanced Strategies with Trusts, Holdings and Foundations considering Jurisdictions in South America, the Caribbean and the USA

Introduction: International succession planning in the Americas has gained complexity and importance, especially with the increased mobility of wealth between ...