Introduction:

Offshore Feeder Funds have become an increasingly popular structure in the global investment landscape, offering flexibility and tax efficiency to a diverse range of investors. With a global offshore fund market valued at over $11 trillion, understanding and effectively implementing these structures is crucial for fund managers and international investors.

In this comprehensive guide, we will explore the intricate details of setting up Offshore Feeder Funds, with a special focus on Cayman-Delaware structures and the strategic use of blocker corporations. From basic fundamentals to more complex considerations, we’ll provide practical insights and advanced strategies for navigating this sophisticated investment environment.

Part 1: Ready to Roll 🚀 – Basic Strategies and Practical Actions

Part 1, “Ready to Roll”, offers practical actions and immediate advice for entrepreneurs who need quick and effective guidance.

1. Understanding Offshore Feeder Funds

Definition and Basic Concept

- Explanation of the master-feeder structure

- Role of the offshore feeder fund in attracting international investors

Advantages and Challenges

- Tax and regulatory benefits

- Operational and compliance complexities

2. Cayman-Delaware Structures: An Overview

Cayman Islands as an Offshore Jurisdiction

- Regulatory and tax advantages of the Cayman Islands

- Types of entities available (e.g. Exempted Limited Partnerships)

Delaware as an Onshore Jurisdiction

- Benefits of Delaware’s legal environment

- Common structures (Ex: Limited Partnerships, LLCs)

Cayman-Delaware integration

- Typical investment flow and operating structure

- Reporting and compliance considerations

3. Blocker Corporations: Fundamentals

Concept and Purpose

- Definition of a blocker corporation

- Main objectives: tax protection and simplification of reporting

Common Types of Blocker Corporations

- C-Corporations in Delaware

- Offshore entities in jurisdictions such as Cayman

Usage Scenarios

- Effectively Connected Income (ECI) sensitive investors

- Mitigation of tax obligations for non-US investors

4. Initial Steps to Set Up

Strategic planning

- Definition of fund objectives and profile of target investors

- Initial choice of jurisdictions and structures

Basic legal requirements

- Registration required in Cayman and Delaware

- Key documentation (e.g. Partnership Agreements, Offering Memorandums)

Initial Operational Considerations

Establishment of bank and custody accounts

Selection of key service providers (administrators, custodians)

Part 2: Deep Dive 🤿 – Technical Delving into Advanced Strategies

Part 2, “Deep Dive”, provides in-depth analysis for those who wish to delve into the technical and complex aspects of international finance.

5. Detailed Cayman-Delaware Structuring

Master Fund in Delaware

- Advantages of a Delaware Limited Partnership as a Master Fund

- Structuring for tax and operational optimization

Feeder Fund in Cayman

- Use of Exempted Limited Partnerships in Cayman

- Strategies to cater for different international investor profiles

Investment flow and repatriation

- Investment mechanisms from Feeder to Master

- Profit distribution and repatriation strategies

Advanced Regulatory Considerations

- Navigating the requirements of the SEC and CIMA (Cayman Islands Monetary Authority)

- Structuring for FATCA and CRS compliance

6. Blocker Corporations: Advanced Strategies

Sophisticated Blocker Structuring

- Use of cascading blockers for tax optimization

- Check-the-box strategies for tax flexibility

Blocker Corporations vs. Partnerships

- Comparative analysis of tax efficiency

- Optimal use scenarios for each structure

UBTI and ECI mitigation

- Strategies to avoid Unrelated Business Taxable Income

- Structuring to minimize Effectively Connected Income

Substance considerations

- Implementation of “mind and management” in offshore jurisdictions

- Strategies to meet economic substance requirements

7. Tax and Regulatory Optimization

Tax Treaties and International Structuring

- Taking advantage of tax treaty networks

- Treaty shopping strategies and their limitations

PFIC and American Investor Considerations

- Navigating the Passive Foreign Investment Company rules

- QEF (Qualified Electing Fund) election strategies

Anti-Abuse Regulations

- Compliance with CFC (Controlled Foreign Corporation) rules

- Navigating the complexities of GILTI (Global Intangible Low-Taxed Income)

8. Operationalization and Ongoing Compliance

Structuring Governance

- Establishment of investment boards and committees

- Conflict of interest management policies

Reporting and Valuation

- Implementation of robust NAV (Net Asset Value) processes

- Strategies for consolidated reporting in master-feeder structures

Audits and ongoing compliance

- Selection of auditors with expertise in offshore structures

- Development of compliance programs adapted to the structure

9. Technology and Innovation in Offshore Structures

Offshore fund management platforms

- Implementation of integrated systems for master-feeder management

- Automated reporting solutions for multiple jurisdictions

Blockchain and Tokenization

- Exploring tokenization opportunities for feeder funds

- Regulatory and operational considerations for blockchain-based funds

Data Analytics for Compliance

- Use of AI and machine learning for KYC and AML in complex structures

- Predictive tools for regulatory risk management in multiple jurisdictions

10. Trends and Future of Offshore Feeder Funds

Impact of Global Regulatory Changes

- Adapting to initiatives such as BEPS (Base Erosion and Profit Shifting)

- Preparing for potential changes in international tax policies

ESG and Responsible Investment

- Integrating ESG criteria into offshore structures

- ESG reporting challenges and opportunities in multi-jurisdictional funds

Evolution of Feeder Fund Structures

Potential impact of global tax harmonization on offshore structures

Emerging trends in hybrid structures

Conclusion

Structuring a fund with foreign investors in the US, avoiding SEC registration, is a strategy that requires a careful balance between financial innovation and regulatory compliance. While it offers significant advantages in terms of flexibility and efficiency, this approach demands a thorough understanding of the legal nuances and an ongoing commitment to compliance.

Key points to remember:

- The use of regulatory exemptions is key, but requires meticulous attention to detail and legal boundaries.

- Sophisticated offshore structures can offer advantages, but must be implemented with careful consideration of tax and regulatory implications.

- Compliance with international regulations, such as FATCA and CRS, is crucial for long-term success.

- Technological innovation can offer competitive advantages, but must be implemented with care to maintain compliance.

- Managing legal and reputational risks is as important as financial performance for the sustainability of the fund.

By applying the strategies and insights in this guide, fund managers and financial entrepreneurs can effectively navigate the complex regulatory environment, creating structures that meet the needs of foreign investors while operating within legal boundaries. Remember, success in this field is not only measured by financial return, but also by the ability to maintain operational integrity and regulatory compliance over the long term.

The structuring and implementation of Offshore Feeder Funds, particularly using Cayman-Delaware structures and blocker corporations, offers significant opportunities for fund managers and international investors. However, navigating this complex environment requires a thorough understanding of the legal, tax and operational nuances involved.

Key points to remember:

- The choice between Cayman and Delaware structures should be carefully considered based on the objectives of the fund and the profile of the investors.

- Blocker corporations are powerful tools for tax optimization, but require strategic implementation and careful maintenance.

- Ongoing compliance with evolving international regulations is crucial to long-term success.

- Technological innovation offers new opportunities for operational efficiency and compliance, but must be implemented with caution.

- Adaptability to regulatory changes and market trends is essential for the sustainability of offshore structures.

By applying the strategies and insights in this guide, fund managers and financial professionals can structure Offshore Feeder Funds that not only meet the current needs of their investors, but are also prepared for future challenges and opportunities in the global investment landscape.

FAQs

- Q: What are the main advantages of using a Cayman-Delaware structure for Offshore Feeder Funds? A: The main advantages include:

- Tax flexibility for international investors

- Favorable regulatory environment in Cayman for offshore funds

- Legal robustness and well-established jurisprudence in Delaware

- Ability to efficiently serve different investor profiles

- Possibility of tax optimization through blocker structures

- Q: How do blocker corporations benefit non-US investors in Offshore Feeder Funds? A: Blocker corporations offer significant benefits:

- Protection from direct exposure to Effectively Connected Income (ECI)

- Simplification of US tax and reporting obligations

- Mitigation of FIRPTA-related risks for real estate investments

- Possibility of advantageous tax elections (e.g. “check-the-box”)

- Potential reduction in overall tax burden for certain types of investors

- Q: What are the main regulatory challenges in holding Offshore Feeder Funds? A: Key regulatory challenges include:

- Compliance with FATCA and CRS in multiple jurisdictions

- Navigating substance requirements in offshore jurisdictions

- Adapting to frequent changes in international tax regulations

- Managing AML/KYC risks in complex structures

- Balancing regulatory transparency and investor privacy

- Q: How is technology impacting the management and operation of Offshore Feeder Funds? A: Technology is having a significant impact:

- Implementation of integrated systems for managing master-feeder structures

- Use of blockchain to improve transparency and operational efficiency

- Adoption of AI and machine learning for compliance and risk management

- Development of automated reporting platforms for multiple jurisdictions

- Exploring tokenization to increase liquidity and accessibility

- Q: What are the future trends that could affect the viability of Offshore Feeder Funds? A: Important trends to consider include:

- Growing pressure for global tax transparency

- Potential harmonization of international tax rules (e.g. global minimum tax initiative)

- Increasing focus on ESG and responsible investment

- Evolution of crypto regulations and their impact on fund structures

- Changes in economic substance policies in offshore jurisdictions

Remember, the Offshore Feeder Funds landscape is constantly evolving. It is crucial to keep up to date with regulatory and market changes, and always seek expert legal and tax advice when structuring and operating these complex vehicles.

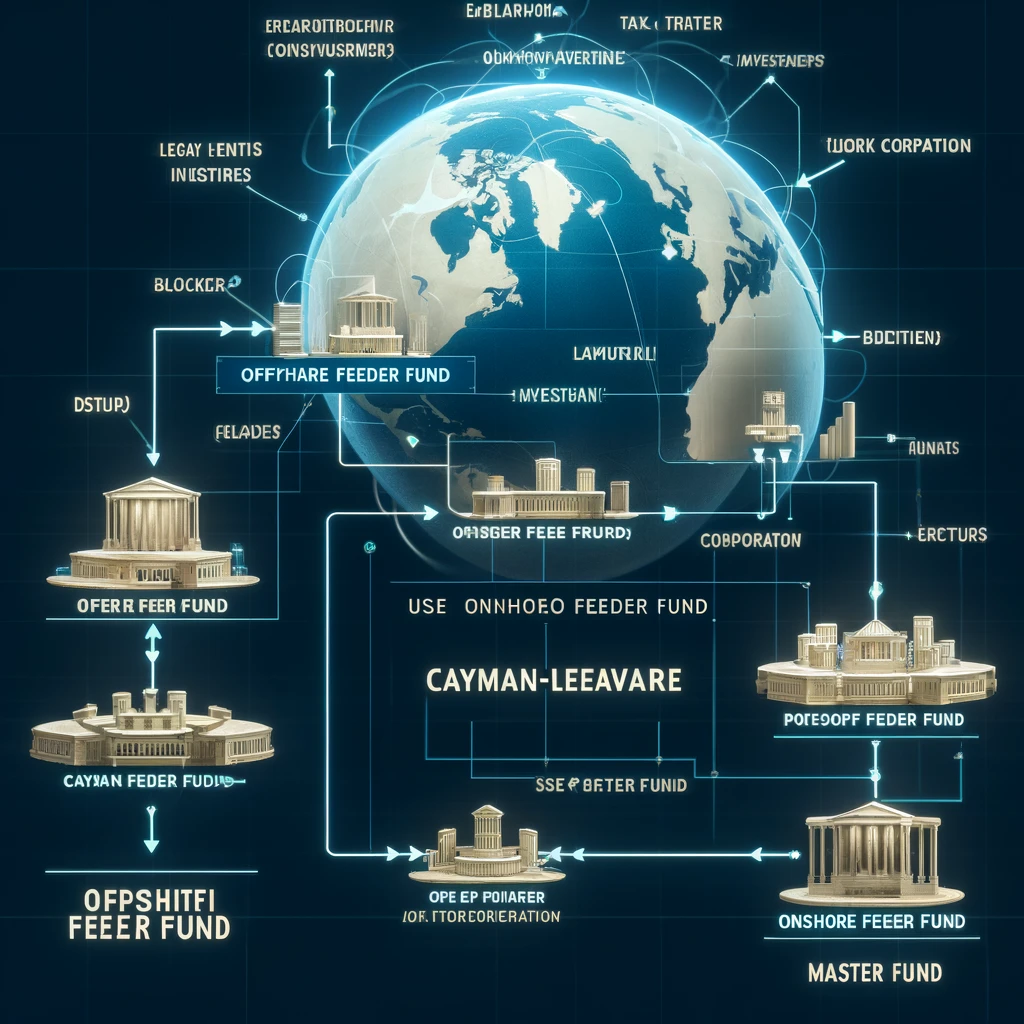

Organizational Chart Description: Typical Offshore Feeder Fund Structure

Top Level: Investors

- Non-US Investors

- Individuals

- Institutions

- US Tax Exempt Investors

- Foundations

- Pension Funds

- US Taxable Investors

- Individuals

- Taxable Entities

Intermediate Level: Feeder Funds

- Offshore Feeder Fund (Cayman Islands)

- Exempted Limited Partnership

- Receives investments from Non-US Investors and US Tax Exempt Investors

- Blocker Corporation (Cayman Islands)

- Exempted Company

- Wholly owned subsidiary of Offshore Feeder Fund

- Onshore Feeder Fund (Delaware, USA)

- Limited Partnership

- Receives investments from US Taxable Investors

Lower Level: Master Fund

- Master Fund (Delaware, USA)

- Limited Partnership

- Receives investments from:

- Offshore Feeder Fund (via Blocker Corporation)

- Onshore Feeder Fund

- Carries out all investments and trading operations

Investment flows

- Downward arrows connecting:

- Non-US Investors and US Tax-Exempt Investors → Offshore Feeder Fund

- Offshore Feeder Fund → Blocker Corporation

- Blocker Corporation → Master Fund

- US Taxable Investors → Onshore Feeder Fund

- Onshore Feeder Fund → Master Fund

Member of the IMA (Institute of Management Accountants) – USA

Member of the AICPA (American Institute of CPAs) – USA

Member of AAII (American Association of Individual Investors) – USA

Member of AAA (American Accounting Association) – USA

Member of the FMA (Financial Management Association) – USA

These associations not only attest to Kleyton’s commitment to professional excellence, but also ensure that his knowledge is always at the forefront of international financial and accounting practices.

With a robust academic background, including a Bachelor’s degree in Accounting and MBAs in International Finance and Accounting, as well as in International Business, Kleyton offers a unique and comprehensive perspective on the global business landscape.

Through the Tartarotti Report, Kleyton invites visionary entrepreneurs and executives to connect, explore opportunities for collaboration and, together, successfully navigate the complex world of international corporate finance.