In the complex universe of tax and inheritance obligations, the declaration of a property received by inheritance emerges as a topic of crucial importance and often of considerable confusion. The correct declaration not only guarantees legal compliance, but is also fundamental to avoiding future problems with the tax authorities and ensuring the smooth enjoyment of the inherited property.

Recent data from the Internal Revenue Service indicates that every year, around 30% of income tax returns that include inherited assets present some kind of inconsistency. This alarming figure highlights the need for a clear and precise understanding of how to proceed correctly in these situations.

This guide has been meticulously put together to demystify the process of declaring property received through inheritance, transforming a potentially complex procedure into clear and actionable steps. Whether you are a recent heir, a lawyer specializing in inheritance law, or an accountant dealing with estates, our goal is to provide a comprehensive and practical roadmap for navigating this important aspect of estate and tax planning.

Part 1: Ready to Roll 🚀 – Basic Strategies and Practical Actions

Part 1, “Ready to Roll”, offers practical actions and immediate advice for business owners who need quick and effective guidance.

1. Understanding the Inheritance Process: Basic Concepts

Before tackling the declaration itself, it is crucial to understand the inheritance process and its fundamental concepts:

- Opening of Succession: Occurs at the moment of death, when the assets of the deceased (de cujus) are transferred to the heirs.

- Inventory: Legal process that formalizes the transfer of assets, which can be judicial or extrajudicial.

- Sharing: Formal division of assets among the heirs.

- Formal de Partilha or Escritura de Inventário: Document that formalizes the transfer of property.

- ITCMD (Imposto sobre Transmissão Causa Mortis e Doação): State tax due on the transfer of assets by inheritance.

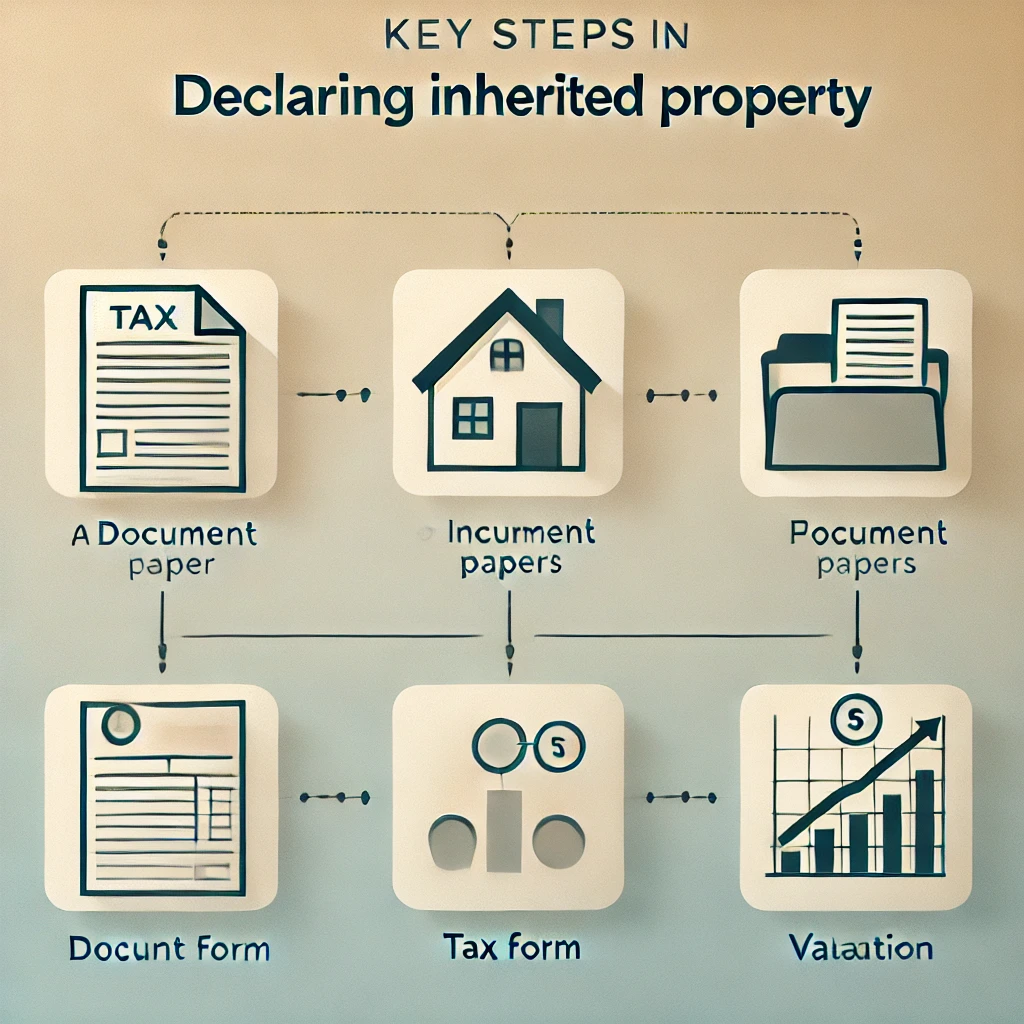

2. Initial Steps for the Declaration

When preparing to declare a property received through inheritance, follow these initial steps:

- Gather Documentation:

- Death certificate of the deceased

- Partition Form or Inventory Deed

- Proof of ITCMD payment

- Property documents (updated registration, IPTU)

- Check the Inventory Status:

- If not yet completed, the property should be declared in the “Estate” field

- If completed, declare in your name in the appropriate field

- Determine the Value to be Declared:

- Generally, the value stated in the ITCMD or in the appraisal for inventory purposes is used

- Identify the Time of Declaration:

- The first declaration after receiving the inheritance is crucial

3. Filling in the income tax return

The correct completion of the declaration is essential:

- Location in the Declaration:

- Use the “Assets and Rights” field

- Select the appropriate code (e.g. 11 for a house, 12 for an apartment)

- Information to be filled in:

- Description of the property (full address)

- Date and form of acquisition (inheritance)

- Number of the inventory process or public deed

- Property value

- Value to declare:

- In the year of receipt: declare the value at which the property was appraised in the inventory

- In subsequent years: keep the same value, unless there are improvements

- Fraction of the property:

- If you inherited only part of the property, declare only your fraction

- Important notes:

- Include information on ITCMD paid

- Mention other heirs, if applicable

Part 2: Deep Dive 🤿 – Technical Delving into Advanced Strategies

Part 2, “Deep Dive”, provides in-depth analysis for those who want to dive into the technical and complex aspects of international finance.

4. Tax Treatment and Tax Implications

Understanding the tax implications is crucial for efficient wealth management:

ITCMD (Imposto sobre Transmissão Causa Mortis e Doação):

- Rates: Vary by state, generally between 2% and 8%

- Calculation Basis: Venal value of the property or declared value, whichever is greater

- Payment Deadline: Varies by state, usually 30 to 180 days after death

- Exemptions: Some states offer exemptions for low-value properties or for spouses and children

Income tax:

- Inheritance Exemption: Receipt of the inheritance itself is exempt from income tax

- Capital Gain on Future Sale:

- The value declared in the inventory is used as the acquisition cost

- Possible exemption if it is the only property and the sale value is up to R$ 440,000.00 (check current legislation)

Other Taxes and Fees:

- IPTU: Responsibility for payment is transferred to the new owner

- Condominium fees: become the responsibility of the heir after division

5. Special situations and their treatment

Some situations require special attention:

Property in Inventory:

- Declare in the “Estate” field until the inventory is completed

- After the division, transfer it to your name in the next declaration

Usufruct:

- Nu-proprietário: Declare the total value of the property

- Usufructuary: Declares the right of usufruct, usually 1/3 of the value of the property

Inheritance from spouse/partner:

- Pay attention to the half share (50% that already belonged to the surviving spouse)

- Declare only the part actually inherited

Property abroad:

- Declare using the specific code for property abroad

- The value must be converted to reais at the exchange rate on the last day of the year

Minor or incapacitated heirs:

- Parents or guardians must declare in the declaration of the minor/incapacitated person

- Use a separate declaration for minors/incapacitated persons

6. Common Mistakes and How to Avoid Them

Avoiding common mistakes is crucial to preventing problems with the tax authorities:

- Not declaring the property:

- Mistake: Believing that because it’s an inheritance it doesn’t need to be declared

- Prevention: Always declare, even if the inventory has not been completed

- Declaring an Incorrect Value:

- Error: Use outdated or arbitrary value

- Prevention: Use the value in the ITCMD or inventory valuation

- Omitting Relevant Information:

- Error: Not mentioning other heirs or details of the process

- Prevention: Include all relevant information in the description field

- Declare in Wrong Field:

- Error: Use inappropriate field (e.g. declare as owned property while still in inventory)

- Prevention: Check the inventory status and use the appropriate field

- Do not update the declaration after sharing:

- Error: Keep the property in the “Estate” field after completion of the inventory

- Prevention: Transfer to your name in the declaration following the division

- Inconsistency between declarations:

- Error: Divergent information in consecutive years without justification

- Prevention: Keep clear records and be consistent in annual declarations

7. Succession Planning and Future Implications

Considering succession planning is essential for efficient wealth management:

Living Gift vs. Inheritance:

- Compare tax and practical implications of lifetime gifting vs. inheritance

- Consider aspects such as ITCMD, possible discounts and control over the asset

Asset Holding:

- Evaluate the possibility of transferring the property to a family holding company

- Benefits include easier management and potential tax optimization

Will and Advance Planning:

- Importance of a clear will to avoid conflicts and facilitate the probate process

- Consider instruments such as trusts or real estate investment funds for efficient asset management

Impact on Future Generations:

- Assess the tax and financial impact of transferring real estate assets to heirs

- Consider financial education strategies to prepare heirs for wealth management

8. Trends and Legislative Changes

Being aware of legislative changes is crucial for effective wealth management:

Tax Reform:

- Potential changes to ITCMD rates and calculation bases

- Possible changes to the rules for taxing capital gains on the sale of inherited property

Simplification of Processes:

- Trend towards simplification and digitalization of probate processes

- Potential impact on the speed and cost of transferring inherited assets

New forms of ownership:

- Emergence of new types of real estate ownership (e.g. tokenization of real estate)

- Implications for declaration and management of inherited assets in non-traditional formats

Internationalization:

- Growing relevance of international inheritance issues

- Need to understand international treaties and cross-border taxation rules

Conclusion

The correct declaration of an inherited property is a process that requires attention to detail, an understanding of legal and tax obligations, and a strategic look at long-term estate planning. Although it may seem complex at first glance, with the right knowledge and appropriate guidance, it is possible to navigate this process efficiently and in full compliance with the law.

Key points to remember:

- Document everything meticulously, from the inventory process to annual declarations.

- Be aware of tax deadlines and obligations, especially the ITCMD.

- Be consistent and accurate in the information you declare over the years.

- Consider succession planning as an integral part of wealth management.

- Keep abreast of legislative changes that may impact the management of inherited assets.

For those facing this process, remember: accuracy and transparency in the declaration are not only legal obligations, but also powerful tools for effective and smooth wealth management. In the event of doubts or complex situations, don’t hesitate to seek professional advice from lawyers specializing in inheritance law or accountants with experience in estate planning.

The journey of managing an inherited estate is both a privilege and a responsibility. With the right approach, you can honor the legacy you have received and at the same time build a solid foundation for your and your family’s financial future.

To deepen your knowledge in this crucial area, we invite you to take part in our next webinar: “Masterclass in Inherited Wealth Management: Advanced Strategies for Tax Optimization and Efficient Succession”. In this event, we will discuss detailed case studies and offer practical insights from industry experts.

Member of the IMA (Institute of Management Accountants) – USA

Member of the AICPA (American Institute of CPAs) – USA

Member of AAII (American Association of Individual Investors) – USA

Member of AAA (American Accounting Association) – USA

Member of the FMA (Financial Management Association) – USA

These associations not only attest to Kleyton’s commitment to professional excellence, but also ensure that his knowledge is always at the forefront of international financial and accounting practices.

With a robust academic background, including a Bachelor’s degree in Accounting and MBAs in International Finance and Accounting, as well as in International Business, Kleyton offers a unique and comprehensive perspective on the global business landscape.

Through the Tartarotti Report, Kleyton invites visionary entrepreneurs and executives to connect, explore opportunities for collaboration and, together, successfully navigate the complex world of international corporate finance.